Business Modelビジネスモデル

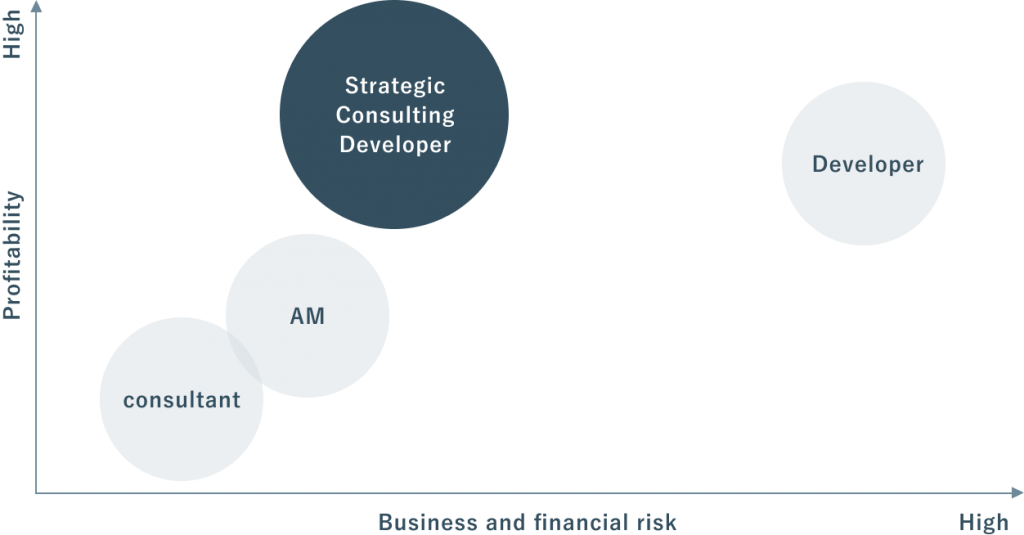

We have created a business model that is a fusion of the functions of a strategic consulting developer and a fund manager.

Business Model KC 1.0

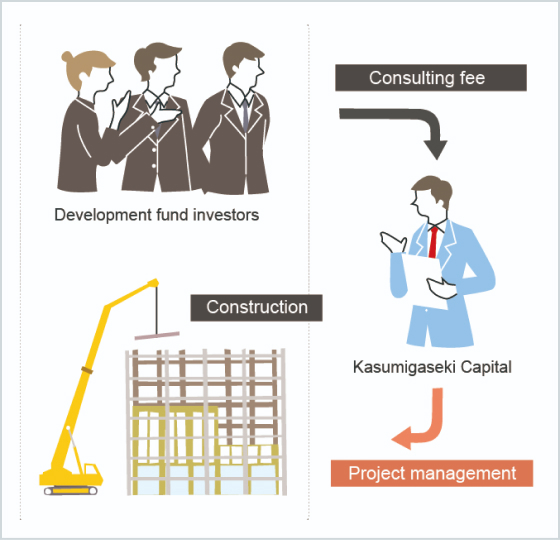

Strategic Consulting Developer

Success Fee Oriented Fund Manager

Sold to development fund investors after adding value to land

First, we acquire land for development. Then we create plans with the most favorable conditions and sell the plot on to development fund investors after adding value to the land. This process takes about six months. Once sold, the asset is effectively off the balance sheet making for a sound financial standing.

Performance rewards earned while moving along the project

In this phase the project comes into action. While being involved in project management as a developer, we also manage the asset as a fund manager. We then receive consulting fees from the development fund investors.

Sold to core fund investors after completion

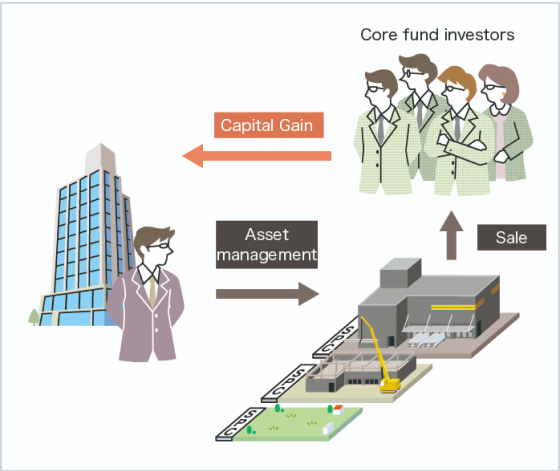

Once the building work is complete, the site is sold by the development fund investors to the core fund investors, and Kasumigaseki Capital receives a success fee. By also managing the assets of the core fund, we continuously increase its property value and as a turn receive an asset management fee.

Business Model KC 2.0

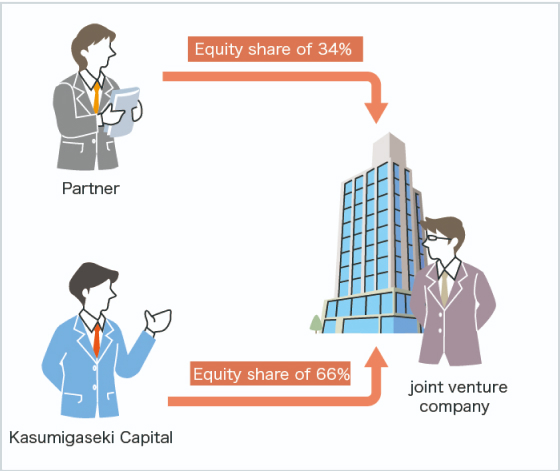

Joint venture set up

We establish a joint venture by investing together with a partner (Kasumigaseki Capital: 66%, Partner company: 34%).

* A joint venture is a company established by two or more entities to jointly conduct business.

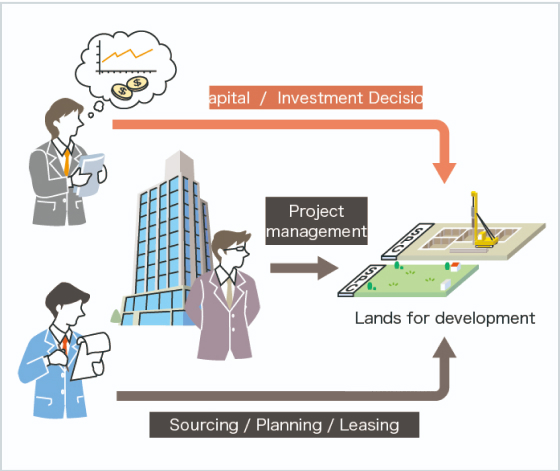

Development by using SPE

The joint venture establishes a special-purpose entity (SPE) for each project. After transferring ownership of the land to the SPE, the joint venture then proceeds with its series of projects.

* A special-purpose entity is a company created to fulfill a specific objective, such as holding real estate.

Sold to core fund investors after completion

Completed assets are sold to core fund investors. The joint venture continues to manage the asset and strives to maintain and improve asset value.

Strategic Consulting Developer

Success Fee Oriented Fund Manager

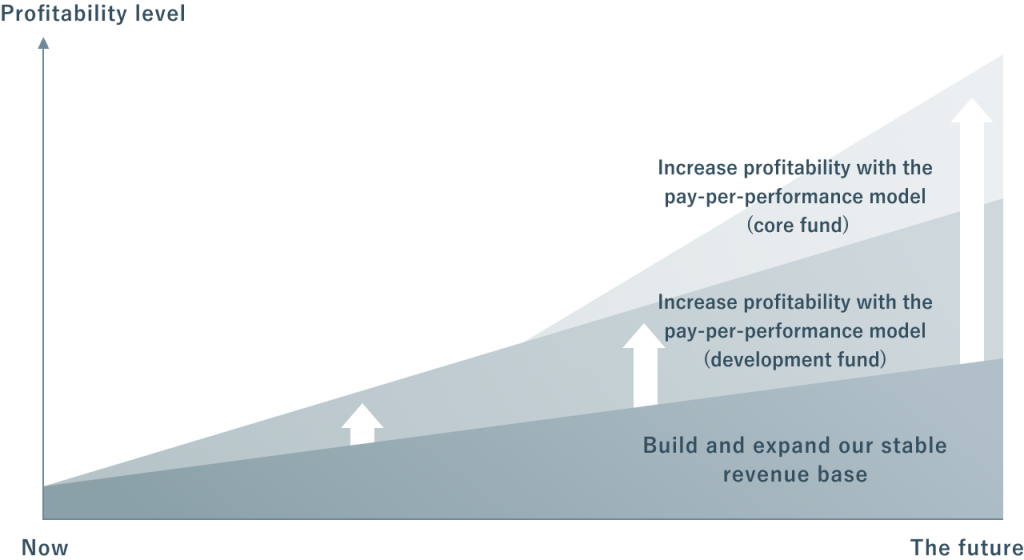

Secure a stable revenue base using the recurring revenue business model while increasing revenues by utilizing the pay-per-performance model

The conceptual diagram of profitability in the fund business

Business Assets主な対象アセット

•For each asset we develop optimal plans and propose strategies for maintaining and improving the asset’s value and maximizing investment returns.

Details

Logistics Business

We are developing cold-chilled warehouses, automated cold-chilled warehouses, and other logistics facilities in response to growing demand due to factors including the upcoming 2030 HCFC phaseout and the increased consumption of frozen foods.

Hotel Business

We are developing hotels with the aim of helping make Japan a tourism powerhouse-oriented nation and promoting regional development. To this end, we are working to expand our hotel brand(fav,FAV LUX,seven x seven) nationwide.

Healthcare Business

We are working to address Japan’s challenges as a super-aged society by developing new healthcare facilities.

Other Business

We are engaged in overseas business in the United Arab Emirates (Dubai) and in Southeast Asia with an aim to create new real estate investment opportunities.